How to Get a Hospital Bed Through Insurance or Medicare (Step-by-Step Guide)

📋 KEY TAKEAWAYS

| Step | Requirements |

|---|---|

| Doctor Documentation | Detailed prescription and face-to-face evaluation |

| Medicare Coverage | Part B covers 80% after meeting deductible |

| Private Insurance | Varies by plan; requires prior authorization |

| Medical Necessity | Must prove condition requires bed features |

| Supplier Selection | Must use Medicare-enrolled or in-network provider |

How to get a hospital bed through insurance or Medicare requires following a specific process that begins with obtaining a doctor's prescription documenting medical necessity.

Most insurance plans, including Medicare Part B, will cover 80% of the approved amount for a hospital bed when properly prescribed and obtained through an authorized supplier.

This guide walks you through each step of the process to successfully secure insurance coverage for the medical beds you need.

Understanding the exact requirements and process can significantly increase your chances of approval and reduce out-of-pocket costs for essential home medical equipment. Whether you need a standard electric bed, a specialized bariatric model, or specific pressure-relief mattress, insurance coverage can make these vital healthcare tools more accessible.

Step 1: Obtain a Doctor's Prescription and Documentation

The foundation of any successful insurance claim for a hospital bed starts with proper medical documentation.

Required Medical Documentation

Your doctor must provide:

-

Detailed prescription specifying:

- Diagnosis requiring a hospital bed

- Specific bed features needed (electric, semi-electric, bariatric, etc.)

- Expected duration of need (rental vs. purchase)

- Medical justification for each required feature

-

Face-to-face evaluation notes documenting:

- Physical examination findings

- Functional limitations

- Why a regular bed is inadequate

- How the hospital bed will improve the condition

-

Certificate of Medical Necessity (CMN) including:

- Form CMS-849 for Medicare

- Clinical justification for medical necessity

- Provider signature and NPI number

- Date of evaluation and prescription

Qualifying Medical Conditions

Insurance typically covers hospital beds for conditions such as:

- Severe cardiac conditions requiring head elevation

- Respiratory disorders needing positioning for breathing

- Chronic pain requiring frequent position changes

- Post-surgical recovery with positioning requirements

- Mobility limitations requiring specialized transfer capabilities

- Pressure sores or high risk for skin breakdown

For example, specialized beds like the Trendelenburg Hospital Bed by Medacure may be prescribed for specific circulatory or respiratory conditions requiring precise positioning.

Step 2: Understand Your Insurance Coverage

Different insurance plans have varying requirements and coverage levels for durable medical equipment (DME).

| Insurance Type | Typical Coverage | Requirements |

|---|---|---|

| Medicare Part B | 80% of approved amount after deductible | Medicare-enrolled supplier, documented medical necessity |

| Medicare Advantage | Varies by plan, often follows Medicare guidelines | In-network providers, prior authorization |

| Medicaid | Full coverage in many states | State-specific requirements, approved providers |

| Private Insurance | 50-80% after deductible, varies widely | Prior authorization, in-network providers |

| VA Benefits | Full coverage for qualifying veterans | VA prescription, service-connected need |

Medicare Coverage Specifics

Medicare Part B covers hospital beds when:

- Your doctor prescribes it for use in your home

-

You have a medical condition that requires:

- Head elevation to alleviate pain, breathing problems, or circulation issues

- Body positioning not possible in a regular bed

- Attachment of special equipment for treatment

- Frequent position changes only possible with a hospital bed

-

The bed is considered Durable Medical Equipment (DME) and is:

- Durable (long-lasting)

- Used for a medical reason

- Not useful to someone who isn't sick or injured

- Used in your home

- Expected to last at least 3 years

Medicare typically covers 80% of the approved amount after you meet your Part B deductible. You'll be responsible for the remaining 20% unless you have supplemental insurance.

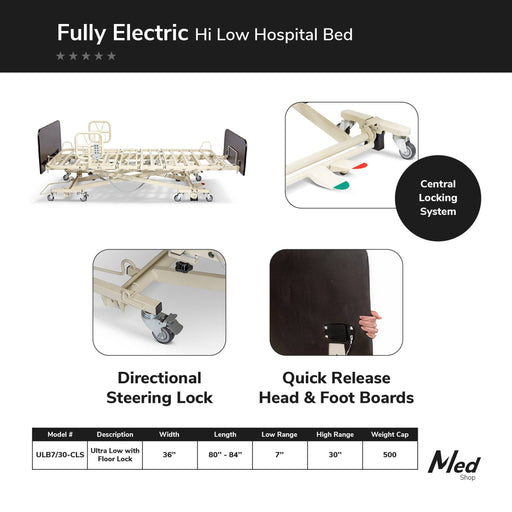

Medical equipment like the Medacure Ultra Low Hospital Bed can be covered when prescribed for fall risk patients requiring the safest possible bed height.

Private Insurance Considerations

For private insurance:

-

Contact your insurance provider to verify:

- Coverage percentage for hospital beds

- Prior authorization requirements

- In-network suppliers

- Documentation needed

- Deductible and co-insurance amounts

-

Check for rental vs. purchase coverage:

- Some plans only cover rentals initially

- Long-term needs may qualify for purchase coverage

- Rental costs may apply toward purchase

-

Verify if supplemental documentation is required beyond standard medical justification

Step 3: Select an Approved Supplier

Using an authorized provider is crucial for insurance coverage.

Finding Medicare-Enrolled Suppliers

For Medicare coverage:

-

Use only Medicare-enrolled suppliers that:

- Accept Medicare assignment

- Bill Medicare directly

- Have proper Medicare supplier numbers

- Follow Medicare pricing guidelines

-

Verify supplier status through:

- Medicare Supplier Directory

- Medicare's website (Medicare.gov)

- Calling 1-800-MEDICARE

Working with Insurance Network Providers

For private insurance:

- Check your insurer's DME provider network

- Confirm the supplier accepts your specific insurance plan

- Verify they will handle prior authorization submission

- Ensure they understand your plan's documentation requirements

Many suppliers like those offering the Costcare High Low Hospital Bed are experienced in working with insurance companies and can guide you through their specific requirements.

Step 4: Completing the Prior Authorization Process

Most insurance plans require prior authorization for hospital beds.

| Step | Details |

|---|---|

| 1. Initiate Request | Your doctor or supplier submits authorization request with medical documentation |

| 2. Insurance Review | Plan reviews documentation for medical necessity (typically 3-10 business days) |

| 3. Decision | Approval, denial, or request for additional information |

| 4. Authorization Number | If approved, a reference number is issued for the claim |

| 5. Appeal (if needed) | If denied, you can appeal with additional documentation |

Documenting Medical Necessity

The key to successful prior authorization is demonstrating medical necessity:

-

Connect the diagnosis to the bed features:

- Explain why each feature is medically required

- Document how the bed will improve the condition

- Include clinical evidence supporting the need

-

Be specific about required features:

- Articulation needs (head, foot elevation)

- Height adjustment requirements

- Side rail necessity

- Weight capacity needs (bariatric models like the Full Electric Bariatric Hospital Bed by Costcare)

- Specific mattress requirements

-

Include supporting test results when applicable:

- Skin assessments for pressure relief needs

- Pulmonary function tests for respiratory conditions

- Mobility assessments for transfer capability

Handling Denials and Appeals

If your initial request is denied:

- Request written explanation of the denial

- Review the specific reason for denial

- Gather additional documentation from your healthcare provider

- Submit a formal appeal following your insurance plan's process

- Consider peer-to-peer review between your doctor and the insurance medical director

Step 5: Rental vs. Purchase Decisions

Insurance often provides different coverage for rentals versus purchases.

Medicare's Rental-to-Purchase Pathway

Medicare typically follows a rental-first approach:

-

Initial 13-month rental period:

- Medicare pays 80% of the monthly rental fee

- You pay 20% coinsurance each month

- Maintenance and servicing included

-

After 13 months:

- Ownership transfers to you

- Medicare will cover major repairs and replacement parts

- You're responsible for routine maintenance

-

Direct purchase options:

- Available if expected use exceeds 13 months

- May be more economical for long-term needs

- Requires specific documentation of long-term necessity

Durable beds like the Emerald Hospital Adjustable Bed Oasis are good candidates for purchase if long-term use is expected.

Private Insurance Considerations

Private insurance policies vary:

-

Review your policy for:

- Rental coverage periods

- Rental-to-purchase options

- Direct purchase allowances

- Maximum benefit amounts

-

Compare long-term costs of:

- Rental only

- Rental-to-purchase

- Direct purchase with maintenance

-

Discuss with your supplier about:

- Warranty coverage under each option

- Maintenance agreements

- Future upgrade possibilities

Step 6: Coordinating Delivery and Setup

Once approved, ensure proper delivery and setup of your hospital bed.

Preparation Checklist

Before delivery:

- Measure doorways and hallways to ensure access

- Clear a space large enough for the bed and necessary clearance

- Verify electrical outlets are accessible and grounded

- Plan for delivery date when assistance will be available

- Confirm component delivery (bed, mattress, rails, etc.)

Setup and Training

During delivery:

- Verify all components match the prescription and authorization

- Request demonstration of all functions and features

- Learn proper operation of controls and safety features

- Understand maintenance requirements

- Get emergency contact information for service needs

Don't forget that special mattresses like the Proex Redistribution Memory Foam Mattress may require specific setup instructions for optimal pressure relief.

Step 7: Follow-Up and Ongoing Coverage

Maintain coverage by following insurance requirements for continued use.

Documentation of Continued Need

For ongoing coverage:

- Schedule required re-evaluations with your doctor

- Update medical necessity documentation as conditions change

- Maintain rental payment records if applicable

- Follow maintenance requirements to preserve coverage

- Report any significant condition changes that may require equipment modifications

Medicare Replacement Provisions

Medicare may cover replacement when:

- The bed has been in use for its reasonable useful lifetime (typically 5 years)

- The bed is lost, stolen, or irreparably damaged

- Your medical condition changes, requiring different equipment

Similar policies often exist for private insurance, but always verify specific terms with your provider.

Frequently Asked Questions

Does Medicare cover electric hospital beds?

Yes, Medicare covers electric hospital beds when prescribed by a doctor for a medical condition requiring specific positioning.

How do I prove medical necessity for a hospital bed?

Provide doctor's documentation showing your condition requires features only available in a hospital bed, like elevation or special positioning.

Will insurance cover a bariatric hospital bed?

Yes, if medically necessary due to weight requirements and prescribed by your doctor with proper documentation.

What's the difference between rental and purchase coverage?

Rental typically covers monthly fees with maintenance included, while purchase coverage provides one-time payment for equipment ownership.

Can I appeal if my hospital bed request is denied?

Yes, you can appeal with additional medical documentation supporting necessity and follow your insurer's specific appeal process.

Does Medicare cover hospital bed mattresses?

Medicare covers specialized mattresses when medically necessary and prescribed along with the hospital bed.

How long does insurance approval for a hospital bed take?

Typically 3-10 business days for initial review, though complex cases may take longer.